However, this may mean that you may need to adjust your budget to account for the extra spending. From this, you can be more careful not to overspend in that area in the following month. If you go over budget, this will help determine where you went over budget.

Track your expenditure against your budget throughout the month. You can use this information to make your budget more efficient. If you do this daily for a couple of weeks, you will develop an accurate record of your spending. You can also keep a spending diary to keep track of your spending. Even some of your fixed expenses can be cut, such as switching your energy provider, changing your phone contract, or looking for possible tax reductions. Eating out and entertainment are examples of variable expenses that are often the simplest to adjust.

HOUSEHOLD BUDGET EXAMPLE FREE

Reduce or eliminate spending in “want” categories to free up funds for the things you “need” to buy. This can be done by creating a “wants and needs” list to evaluate your spending. This is something you’ll have to resolve, as it could lead to problems with debt.

If you have a negative net income, it means you’re spending more than you receive. Make a note of the number, even if it is negative. To calculate your net income, subtract your monthly expenses from your monthly income. Preferably this should be a positive figure so you can save money, pay debt, or other financial goals. Step 3 – Calculate your net incomeĪfter all of your expenses have been paid, your net income is the amount left over. However, including those recurring items in your monthly budget can help you pay for them when they are needed. Keep in mind that some of your expenses do not occur on a monthly basis. Make sure to account for any expenses that may be shared, or costs that are spent on others, especially if you have children. When creating your household budget you also have to consider how your budget is going to be allocated among your household members. As well as this, collect all of your bills and receipts in one place so that you have all these figures in front of you. Reviewing your previous spending might also help you identify areas where you may have overspent. Use your recent bank and credit card statements to figure out how much money you spend on a monthly basis. Accurate figures allow you to discover exactly how much comes in and how much goes out. The effectiveness of a budget depends on the accuracy of its figures. It is important not to make estimates when calculating your expenses. For each variable expense, you should list the maximum amount you intend to spend on that expense or what you expect the bill to be. Make a list of all your fixed expenses, along with their amounts. Some of your monthly expenses are set in stone, such as your rent, taxes and childcare, while other expenses can fluctuate. You can begin by calculating how much money you earn each month by adding up all your sources of income. Your budget should be completely dependable, so if you receive money from side employment or hobbies, but not on a regular basis, don’t include these figures as income. The first step is to calculate your income. Here’s how you can create a new household budget to help manage rising living costs.

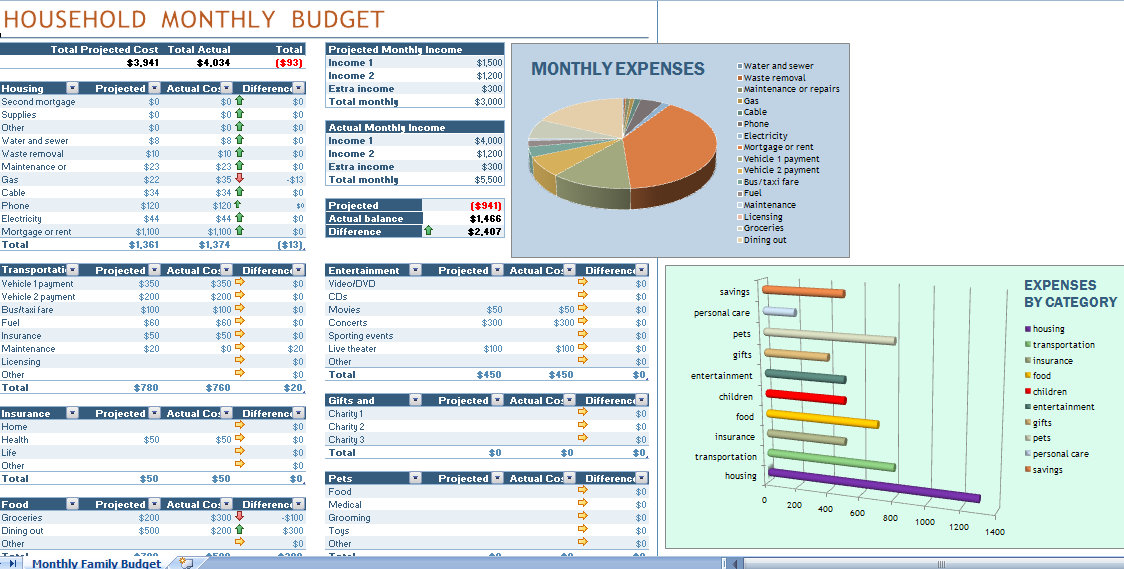

HOUSEHOLD BUDGET EXAMPLE UPDATE

So if you already have a budget now may be time to update it. Figuring out where you’re spending your money can help you prioritise what you do with it to stay within your budget.įinances fluctuate on a regular basis, so it’s important to adjust and keep your budget up to date. You can easily overspend or rely on credit cards and loans to meet your payments if you don’t have a clear picture of what’s flowing in and out of your bank account. It assists you in determining how much you can afford to spend and ensuring that you have sufficient funds left over.

A budget can help you manage your finances, regulate your spending, and stay debt-free. Households are facing more financial pressure than ever before to meet these demands, but here at Citizen’s Advice Cardiff & Vale we are here to help.Ĭreating a household budget is an essential part of creating a solid financial spending plan. Millions of households across the UK are struggling to make ends meet due to the rising cost of living.

HOUSEHOLD BUDGET EXAMPLE HOW TO

Roald Dahl’s Marvellous Children’s Charity Benefits Helplineĭealing with the rising cost of living – How to create a Household Budget in 2022.Private Rented Sector Debt Advice Helpline.Motor Neurone Disease Association Benefits Advice Service.

0 kommentar(er)

0 kommentar(er)